Profit is what you take home after deducting your expenses from your revenue. You could be raking it in and still not have enough money on hand to pay your suppliers.

Since cash flow is the oxygen of every business, make sure you monitor this weekly, or at least monthly. This is most easily calculated by subtracting the amount of money available at the beginning of a set period of time and at the end. You have positive cash flow if there is more money coming into your business over a set period of time than going out. Your cash flowĬash flow is all money traveling into and out of a business. These are startup costs like moving offices, equipment, furniture, and software, as well as other costs related to launch and research. One-off costs fall outside the usual work your business does. Make sure you file your different salary costs in the correct area of your budget.įurther reading: Variable Costs (A Simple Guide) 4. For example, your core in-house team is usually associated with fixed costs, while production or manufacturing teams-anything related to the production of goods-are treated as variable costs. The cost of salaries can fall under both fixed and variable costs. A clear budget plan outlines what you expect to spend on all these costs. Other variable costs can include sales commission, credit card fees, and travel. Variable costs might include raw materials, inventory, production costs, packaging, or shipping. These change according to production or sales volume and are closely related to “ costs of goods sold,” i.e., anything related to the production or purchase of the product your business sells. These are all your regular, consistent costs that don’t change according to how much you make-things like rent, insurance, utilities, bank fees, accounting and legal services, and equipment leasing.įurther reading: Fixed Costs (Everything You Need to Know) 3. It can be based on last year’s numbers or (if you’re a startup), based on industry averages. It’s all of the cash you bring in the door, regardless of what you spent to get there. This is the amount you expect to make from the sale of goods or services. If circumstances change (as they do), your budget can flex to give you a clear picture of where you stand at all times.Įvery good budget should include seven components: 1. Finally, start saving money and recording it gradually.The best budgets are simple and flexible.Then print it out and stick it on your clipboard.(Or probably cut from your other expenses). It'll automatically change the rest of the numbers below to get you an idea of how much you'll need to put aside each month. Enter the amount you want to save eventually.

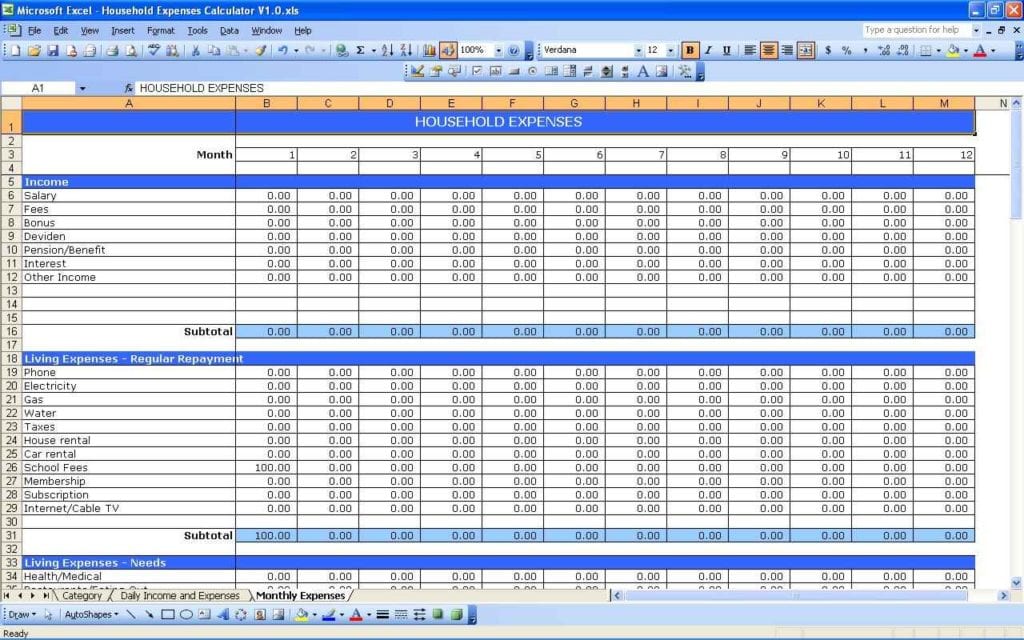

FREE BUSINESS MONTHLY EXPENSES CHART DOWNLOAD

Download and open the template in either Microsoft Excel or Google Sheets.You can use it to save funds for your children's education, or probably something expensive that you always wanted to buy. And how much money you'll need to save each month to finally reach that goal. It'll help you set a final goal-the amount you're willing to save for yourself.

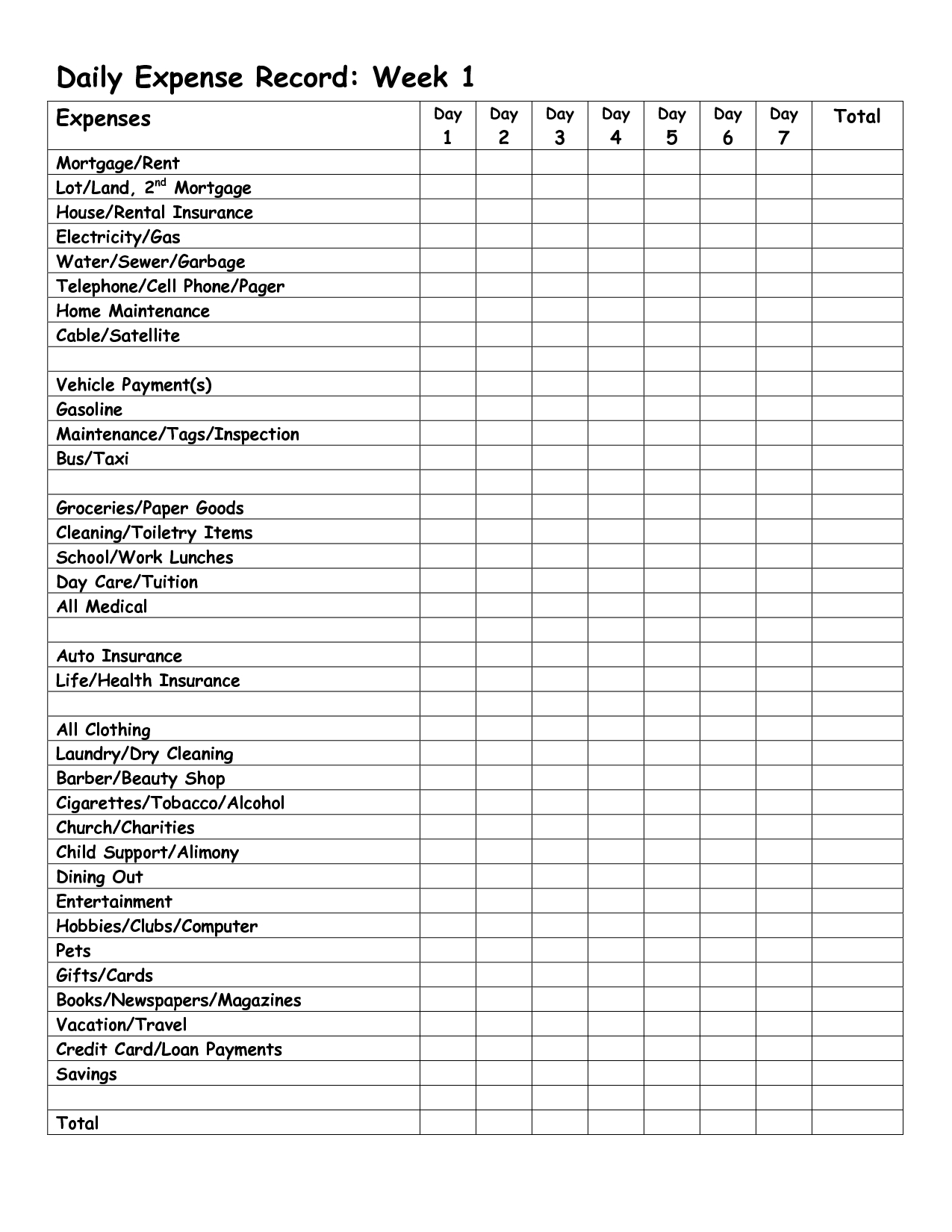

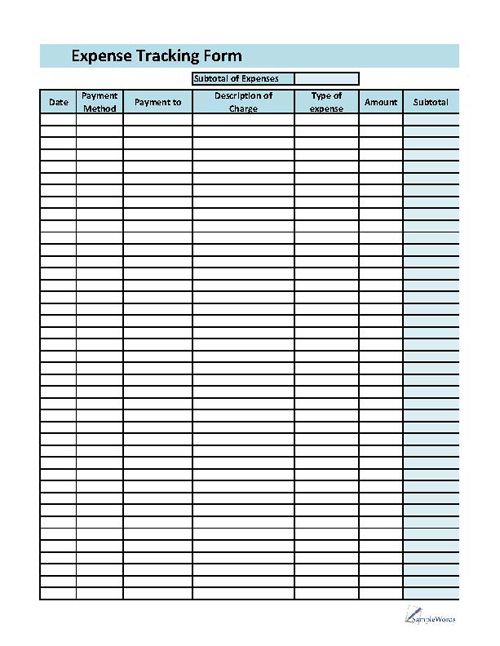

Something to manage how much you should save each month and to keep you on track. Considering you're trying to keep yourself from unnecessary expenses, you should also have a savings tracker. By now, you've got a lot of different expense and income trackers.

0 kommentar(er)

0 kommentar(er)